Hi Sam Sample, Welcome to your

2024 Total Rewards

Total Rewards Package

Your Total Rewards includes more than just your salary. The table below shows estimated annual costs for your Total Rewards package based on your benefit elections and payroll contributions as of May 21, 2024. As a reminder, you can access a summary of their current benefits through Workday.$248,811.75

| Annual Breakdown of your compensation and benefits | ||

| Your Contribution | Spitfire’s Contribution | |

| Total Cash Compensation | ||

|

Includes Paid Time Off

|

– | $178,711.00 |

|

Paid in 2024 for performance in 2023

|

– | $44,677.75 |

| Health and Welfare | ||

|

You have elected Family coverage in the HDHP Medical Plan.

|

$3,120.00 | $12,512.88 |

|

You are currently contributing to the HSA.

|

$3,250.00 | $2,400.00 |

|

You have elected Family coverage in the DPPO Plan.

|

$390.00 | $1,564.20 |

|

You have eleceted Employee + 1 coverage in the Vision plan.

|

$26.04 | $126.24 |

|

You are automatically enrolled in Short-Term Disability at no cost to you.

|

– | $67.20 |

|

You are automatically enrolled in Long-Term Disability at no cost to you.

|

– | $875.76 |

|

You are automatically enrolled in Basic Life and AD&D at no cost to you.

|

– | $728.28 |

|

You have not elected Supplemental Life coverage.

|

– | – |

| Retirement | ||

|

8%

|

$18,000.00 | $7,148.44 |

| TOTAL CONTRIBUTIONS | $24,786.04 | $248,811.75 |

* Reminder: The annual HSA contribution limits are $4,150 for an individual or $8,300 for a family.

Associates age 55 or older can contribute an additional $1,000. Contribution limits include both Associate and Spitfire contributions.

Your Total Rewards

Rollover your rewards chart for more details.

Paid Time Off

Spitfire recognizes the importance of paid time off for rest and relaxation. You are eligible for up to 10 paid holidays (including Company holidays and floating holidays, as applicable) plus an annual paid winter break between Christmas Eve and New Year’s Day. Based on your length of service, you will accrue 20 days of vacation.EQUITY GRANTED †

Your equity awards are also a component of your Total Rewards package. The total value of the equity granted to you is $24,355†. Additional information about your total equity portfolio can be found below.† Equity Award includes grants between January 1 and May 1 and are valued at the close price of $47.24 as of May 21, 2024.

Equity and Retirement Savings Benefits

EMPLOYEE STOCK PURCHASE PLAN (ESPP)

The Employee Stock Purchase Plan (ESPP) gives you the opportunity to become an owner of Spitfire stock and share in our future success. When you join this plan, you have the opportunity to purchase Spitfire stock at a 15% discounted purchase price. There are two ESPP periods per year (September 1 – February 28 and March 1 – August 31).As of May 21 you do not have any ESPP holdings. For more information on the ESPP, visit the Finance page of on our Intranet.

EQUITY AWARDS

(STOCK OPTIONS AND RESTRICTED STOCK UNITS)

Spitfire Associates may receive equity awards during their employment at Spitfire. The current value of your equity awards is dependent upon the market value of Spitfire stock.

Your current ESPP holdings are 147.000 shares valued at $6,574 as of May 21, 2024. For more information on your ESPP account, log into your E*TRADE account at us.etrade.com.

The total current value of your Spitfire equity awards (valued at close price of $47.24 as of May 21, 2024 is $24,355.*

The most accurate and complete summary of your equity awards, including vested and unvested account balances, current value and exercise history, can be found on the E*TRADE website at us.etrade.com or by contacting E*TRADE at 1-800-838-0908.

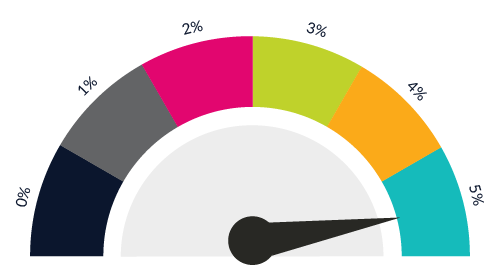

POTENTIAL FUTURE VALUE OF EQUITY OWNERSHIP

The chart below shows how much your total outstanding equity account balance could be worth if the Spitfire stock price increases by 25%, 50% or 100%:

Note: Stock options expire after 10 years and are subject to periodic company blackout periods. We strongly encourage you to monitor your E*TRADE account frequently to ensure you are obtaining the greatest value from your long-term incentive awards.

*Includes grants through May 1, 2024.

401(k) PLAN

Spitfire offers a 401(k) plan to help you prepare for retirement. You may defer up to 100% of your 401(k) eligible earnings up to a maximum annual deferral amount of $18,500 or $24,500 if you are age 50 or older. Spitfire matches 100% of the first 3% of your contributions and 50% of next 2% of your contributions. The match is distributed biweekly throughout the year and is fully vested at the time of contribution.Congratulations on Maximizing Your 401(k) Match!

As of May 21, you were contributing 8% toward the Spitfire 401(k) Plan and received the full Company match! The current value of your 401(k) plan is $23,945.71. Taking full advantage of Spitfire’s match is a smart financial strategy, but are you making the most of your investment opportunities? Speak with one of our free Plan consultants for confidential financial advice tailored to your unique retirement planning needs. Visit the Finance page of the intranet for more information.

Benefit descriptions contained in this statement are based on the best available information and the Company reserves the right to correct all errors. Every effort has been made to ensure the accuracy of this report, but the availability and amounts of all benefits are governed solely by the legal documents involved. This report does not constitute such a legal document. All information is strictly confidential. If you have any questions about your benefits or this statement, please contact the Benefits Team in Human Resources.